ASA GROUP

an independent member firm of PrimeGlobal

Fund Services

Advisory Services

We not only provide advisory on optimal schemes and arrange stakeholders crucial to project success, but we identify management issues and propose solutions during scheme formation and ongoing SPC management. Our comprehensive framework ensures that all tax and accounting matters are covered and that our firm’s wealth of data and expertise is leveraged in considering investment targets, financing arrangements, project stakeholders, and relevant statutory compliance.

We also have a great track record of handling emergency issues that arise during management.

Structuring

Considerations made of the following: Financing, Bankruptcy remoteness, Application of the Corporate Reorganization Act, Avoidance of double taxation, Pass-through schemes, Real estate or trust beneficiary interests, Off balance sheet (true sale rule), Credit enhancement measures, Third party requirements, Loan covenants, Restructuring, etc.

-

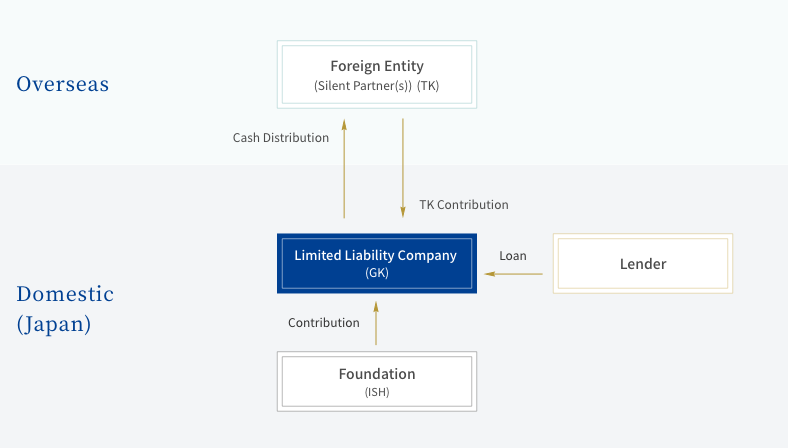

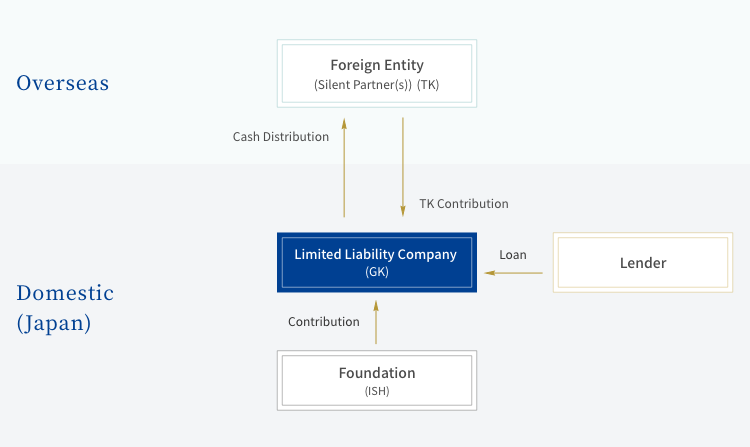

GK-TK Structure

-

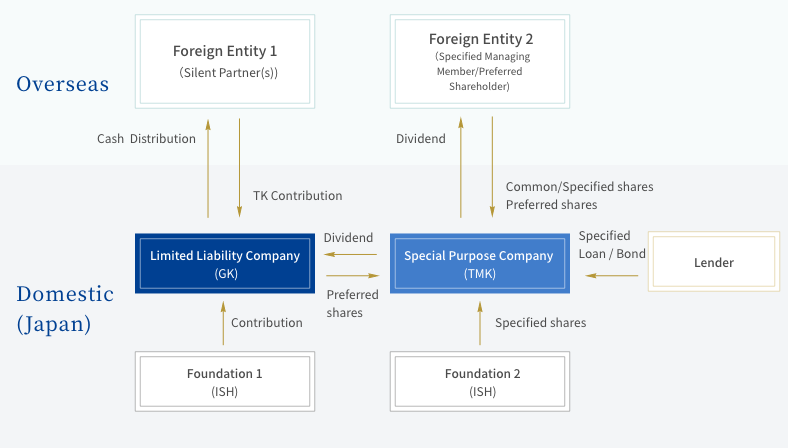

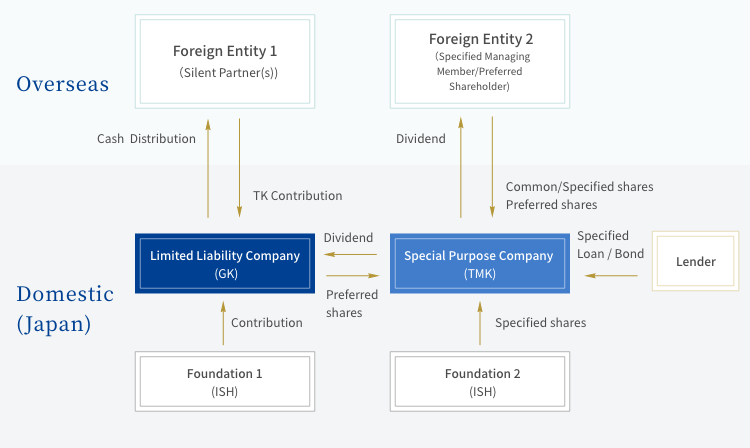

TMK Structure

-

Double SPC Scheme (Multi-structure)

-

Cross-border Transaction Scheme

Applicable Assets

-

Financial assets (accounts receivable, loans receivable, money trusts, guarantee fee receivable, repackaged receivable, etc.)

-

Real estate, Trust beneficiary interest (land, offices, residences, hotels, logistics facilities, commercial facilities, data centers, etc.)

-

Healthcare assets (hospitals, nursing care facilities, etc.)

-

Renewable energy (solar, wind, geothermal, biomass, etc.)

-

Private equity

-

Movable assets (vessels, etc.)

-

WBS (schemes secured by the entire business)

Legal Matters (Relevant Acts and Laws)

Tax Code, Companies Act, Financial Instruments and Exchange Law, Real Estate Syndication Act, Act on Securitization of Assets, Commercial Code, Civil Code, Trust Business Act, Building Lots and Buildings Transaction Act, LPS Act, Money Lending Control Act, etc.

Accounting and tax

Off-balance sheet assessment, Lease assessment, Consolidation assessment, Impairment accounting, Asset retirement obligations, Tax planning, Cash flow simulations, Consumption tax simulations, Tax treaties, Earnings stripping rule, Thin capitalization rule, Group Corporate income tax regulation, Withholding tax treatment, etc.

Common Structure (GK-TK)

zoom

-

When a limited liability company (GK) receives an investment through a silent partnership (TK) under the Commercial Code, the profits from the silent partnership business are distributed and treated as a deductible expense for the GK entity. Thus, the foreign entity which is a silent partner can receive pre-tax profits (i.e. avoid double taxation).

-

As a general rule, upon payment of a profit distribution to a silent partner, the distribution is treated as domestic source income and income tax of 20.42% is withheld.

Common Structure (TMK)

zoom

Special Purpose Company (TMK)

-

When the Special Purpose Company (TMK) satisfies pay-through conditions (e.g. over 50% of issuance of preferred shares are offered in Japan), the profit distribution becomes a deductible expense for the TMK, and thus the Foreign Entity 2 (diagram above) which is a preferred shareholder can receive pre-tax profit (i.e. avoid double taxation).

-

As a general rule, upon payment of a profit distribution to a preferred shareholder, the distribution is treated as domestic source income and thus income tax of 20.42% is withheld. However, if any tax treaty is available with the country of residence of the preferred shareholder, they may be eligible for a reduction or exemption of withholding tax (Applicable tax rates for withholding differ according to each tax treaty. For profit distributions, both the share of voting rights held and the holding period dictate the applicable tax rate as well.)

Limited Liability Company (GK)

-

When a limited liability company (GK) receives an investment through a silent partnership (TK) under the Commercial Code, the profits from the silent partnership business are distributed and treated as a deductible expense for the GK entity. Thus, Foreign Entity 1 which is a silent partner may receive pre-tax profits (i.e. avoid double taxation).

-

Upon payment of a profit distribution to a silent partner, income tax is withheld from domestic source income; however if any tax treaty is available with the country of residence of the silent partner, they may be eligible for a reduction or exemption of withholding tax.

Page Top